Strategy Update – Looking to 2017

This is a special report for Elemental Wealth clients outlining our latest thoughts on world events, stock markets and our preferred investments for 2017. We start by looking at the major economies around the world and how they might affect Australia and then drill down into what this means for Australian investors.

US Economy

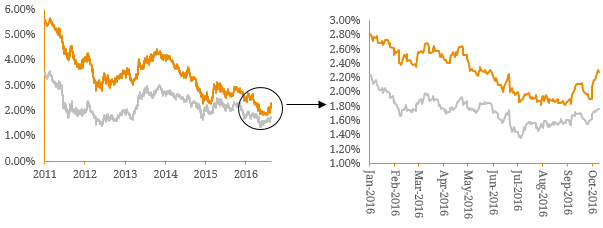

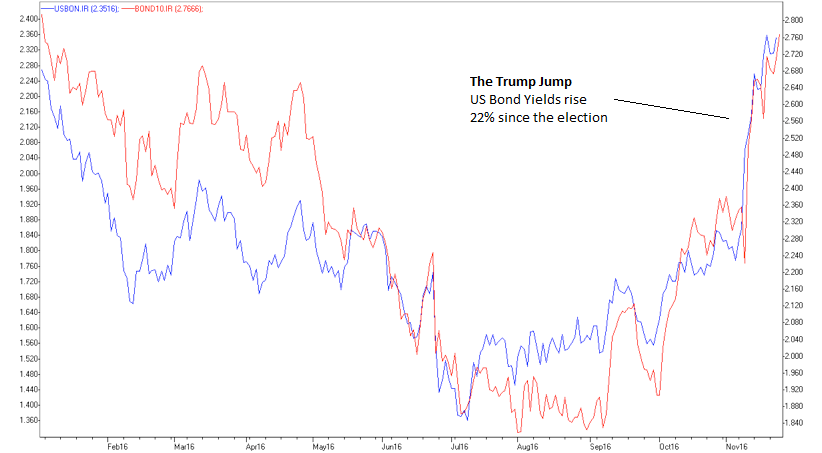

While not widely regarded as having much of a chance, Donald Trump has pulled off something of a coup to become President-elect. The strength of his rhetoric and the impact of his potential policies has caused an unexpected jump in US bond yields, a sign that the era of low interest rates is over (at least in the US).

The given reason for this jump is that Trump’s policies are inflationary in nature – tax cuts for the companies and the middle class and huge amounts of infrastructure spending funded by government debt. This higher inflation should result in higher interest rates over time.

This may be a knee-jerk reaction (it has been priced in without any indication that any of his policies will actually pass into law) so we are expecting at least a moderate pull-back in the short term.

That being said, we can definitely say that we have seen the lows for US interest rates. It appears to be all up from here as their economy is doing quite well. Their economy probably bottomed out last year and forward indicators are showing that growth is accelerating.

This growth reflects the difference between the actions of US corporations and their European counterparts. During this period of low interest rates (kept low by flooding the market with cheap funds), US companies have reduced debt and increased their capital expenditure and the US economy is now starting to reap the benefits.

Australian Economy

Along with the strong rise in US bond yields, the Trump win has also impacted Australian interest rate expectations. Australian bond yields (shown below) have jumped nearly 30% in the past few weeks.