Are You Between 20 & 40?

Not a lot of people in their 20’s, 30’s and even 40’s consider themselves to be an ‘investor’. For the most part, this is understandable. You may not have access to spare cash and you would already be aware that investing appropriately isn’t the easiest thing to accomplish. There are so many variables to take into account.

For the uninitiated it seems like another world, with a language all of its own, dominated by acronyms like ASX, CDO and CFD. You’ve probably shied away from investing for a number of reasons. Maybe you think you need a large sum of money to start the process, you feel there’s too much risk involved or, that there’s so much to it that you feel you have to learn every single detail before you can even get started. In reality, you learn a lot as you go.

Now, I’m not suggesting that you find some random company and invest your entire life savings in it. But whether it’s opening a bank account or taking out a loan, you should always know what you’re getting into when it comes to your money.

Either way, while you may not have a lot of spare cash sitting around, don’t underestimate the worth that you already have. You can still get started. In fact, you already have. Read on for more details.

Superannuation: An Investment in Your Future

While you may not have thousands of dollars of savings sitting around, everybody who is working already has an investment fund established for them. It’s your super, funded by the contributions made by your employer (currently at least 9.5% of your salary, more if you are lucky). This nest egg was established the day you started working.

This pool of money is sitting in the background, slowly accumulating, with the ultimate goal of having enough to fund your retirement.

Retirement may be a long way off, but in the meantime, your super fund can be an invaluable learning tool. If managed correctly can be worth exponentially more than if left to its own devices.

If you want to invest in your future – start with taking control of your super fund.

Most super funds now give you a basic level of control over where and how your money is invested. Generally, you can have control over the asset allocation (the spread of assets between shares, property and cash). Some funds have become more sophisticated, allowing for much more flexibility.

For those who want the ultimate hands-on learning experience, some funds will allow you to establish and manage a portfolio of individual investments.

Timing: Starting Early Makes a Difference

Superannuation is often forgotten (the industry term here is ‘disengagement’). You can’t use the money for another 30 or 40 years, so why care what happens to it now?

Well, taking control not only means learning, it can also mean that you may not have to work as hard later (this is covered more in my post about the upcoming retirement crisis).

The earlier you make a start the better chance your super fund has to grow.

Having a longer timeframe also means you can afford to take higher risks (within reason of course). Higher risks can, but not always, lead to higher returns. Higher returns over a longer timeframe means more money in your pocket.

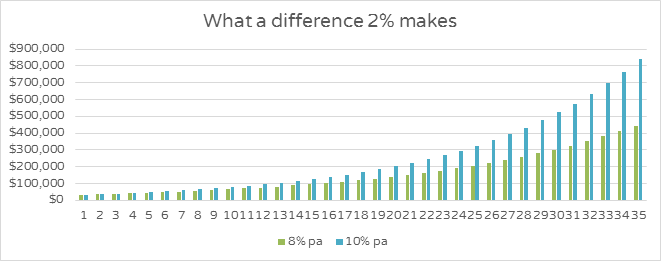

As a simple example, assume you have $30,000 in super. You are 25 years old and don’t really care about what happens with the money. Here is a graph showing the difference a return of just 2% pa more can make over 35 years:

In the early years, there doesn’t seem like much of an advantage, but as the laws of compounding kick in, things really start to move. By the end, an increase of just 2% pa can nearly DOUBLE the account balance ($840,000 versus $440,000). So what are you waiting for?

Insurance: Protection is Important!

Your super fund can also do a lot more than teach you how to invest. It can also protect your assets and income via life, disability and income protection insurance. The best thing is that the premiums are paid by your fund and don’t affect your day-to-day budget. This often means someone who normally couldn’t afford comprehensive cover, will be protected. I’ll touch on this topic in more detail in a future post.

So..Start Already!

So just get started. It’s your money and you can make it work for you. That means taking the time to look at your superannuation statements, reading about things like risk, diversification and asset classes. Guidance from a qualified Financial Planner (like me) can also help. My job is to help client’s understand the ins and outs of the financial world and most importantly to make informed decisions.

If you’d like to know more about how we can help you, simply contact our office to arrange a complimentary initial consultation on 07 5494 0650.