I’ve spoken recently about how the slowdown in China could lead to recession for Australia.

Looking further into this issue, there are some risks that SMSF investors need to consider when reviewing their portfolios.

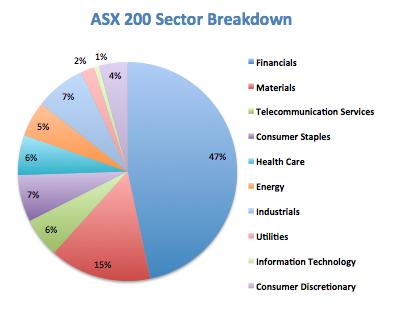

Of the nearly $10 billion invested by SMSF’s in the local market, the mainstay of most SMSF portfolio’s has been the ‘Banks’. Our market is dominated by ANZ, CBA, NAB and Westpac, making up nearly a third of the ASX 200 by value.

With the other finance related stocks they make up more than half of the ASX 200 (see below).

Having a large exposure to the ‘Big Four’ has been a great strategy in the past. They have provided dividend and capital growth pretty much consistently since the early 90’s.

I should know. I spent 15 years working as a stockbroker and investment adviser, and recommending Bank shares were a no-brainer for a SMSF portfolio.

The historical outperformance of the banking sector is in part due to:

- The four pillars policy: enshrining a comfortable oligopoly for the big four

- The mining boom: investment in coal, iron ore and gas pumped billions of dollars into the economy when it needed it most.

- Property: Population growth has led to consistent demand for new dwellings.

Things We Forget About the Banks

While the banks have been a great investment strategy, past performance has made us forget the risks inherent in any banking stock.

Property

At their heart, a Bank’s primary business is consumer loans and residential mortgages. This means they make money by raising capital then on-lending that money to consumers to buy houses and ‘things’.

Profits are made from lending and by charging fees along the way. Continued profit growth needs consumers to increase their borrowing and spending year-on-year.

As Australia’s residential real estate market is already one of the top three most overvalued in the world, increasing lending rates is a tough ask.

This may be the reason behind the recent rate rises by all four big banks.

The Economy

Lending growth is also influenced by consumer confidence and the economic cycle. As an economy slows (and confidence erodes) lending growth will also slow, eating into the bank’s profit growth.

As mentioned earlier, a slowdown in the Australian economy will affect the banks profit growth and hence their dividends and share prices.

My current concerns are:

- Current level of consumer indebtedness (can we ‘grow’ debt any further?)

- Low interest rates – rate rises mean big problems for borrowers

- Slow economic growth – Australian export income has collapsed, as has manufacturing.

- Bad debts are at all-time lows – the only way is up

- Business and consumer confidence is low

Bad Debts

The other risk with a slowing economy is an increase in bad debts. As economic growth falls, confidence drops and consumers and businesses become more vulnerable. Anyone unable to continue to make their loan repayments becomes a bad debt – these come straight off the banks’ bottom line.

The large fall in commodity prices has already seen a wave of liquidations and bankruptcies of mining and mining services companies. Assets held by these companies are being sold off at a fraction of their purchase cost, potentially leaving the banks (as the lender) wearing the difference.

Time to Consider Your Exposure

With all of the above, it is important to consider your amount of exposure to banking stocks. While they still provide good dividend yields, you need to consider if this is sustainable and whether or not you are happy to risk your capital.

If you’d like to know more about how we can help you, simply contact our office to arrange a complimentary initial consultation on 07 5494 0650.