Over the past few years we’ve seen a pretty consistent rise in house prices in Australia (and dramatic rises in Sydney and Melbourne- ~ 50% in a few short years). As a result of this we have heard lots of arguments as to why they have been going up and should continue to do so forever.

While you cannot dispute the fact that prices have risen quickly, all of my economic research suggests that prices rises are less likely in the coming year or two. In fact, conditions are ripe for a reversal of prices as our economic growth stalls, potentially leading into a recession.

Why property prices rise and fall

The price of any asset (shares, property, art etc) are set by the fundamental laws of supply and demand. Supply and demand can be influenced by an almost infinite number of factors, but modern econometric models can usually explain 75%-90% of ‘why’ asset prices rise and fall.

For a property, the price paid is generally a function of:

- Supply – how many houses are for sale in a particular street/suburb/city/state; and

- Demand – how much buyers are can and are willing to pay for the house

In a general sense, supply of housing is influenced mainly by the amount of stock built by developers. A new unit block/housing estate increases the supply of stock available to purchase. Decisions by existing property owners also influence this, but not to the same extent.

Demand (if you want to buy and ultimately how much can you pay) is complicated and can be influenced by some or all of the following:

- Interest Rates – given that 60% of all houses are bought using some form of finance, the cost of borrowing has a huge influence on demand.

- Wages growth – rising wages generally increase disposable income, some people choose to spend this extra income on housing (via higher mortgage payments)

- Unemployment Rate – wages are better than unemployment benefits and a steady job enables us to borrow (and therefore buy a house)

- New Buyers – new demand from first home buyers or overseas investment

- Cost of Rent v Mortgage payments – if the cost of mortgage payments is similar to rental cost this can drive ‘renters’ to become ‘owners’.

Why we’ve been able to pay more

By examining these factors, we can see why house prices have been so buoyant (in an otherwise crappy economy):

Overseas buyers – while this might be only a small number when compared to local home buyers, this incremental demand has been crucial in propping up prices and confidence. It came at the right time too, just as we were dealing with the fall-out from the popping of the mining bubble and the hollowing out of our manufacturing industry. The lower Aussie dollar has also given overseas buyers an extra incentive to invest here.

Interest Rates – again incredible fortuitous timing, lower interest rates came at a time when the economy was under pressure and house prices were slipping. Lower interest rates meant that housing affordability increased, even when prices were rising.

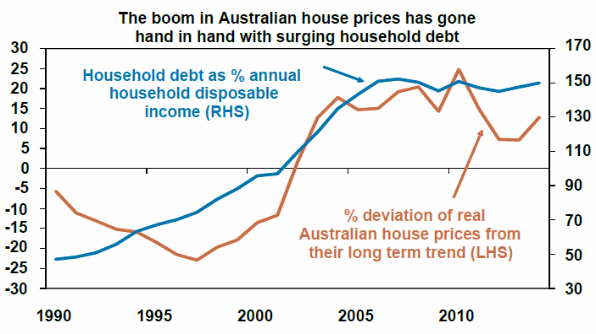

More Debt – by far the biggest driver of house prices in the past few years has been our willingness to take on ever-increasing amounts of debt. By borrowing more we’ve been able to pay higher prices, reinforcing the housing

‘boom’.

Why house prices might start falling

Analysing these economic trends, we see that the data is much less supportive of house prices now and into the future. Here are a few indicators I see that foreshadow lower house prices:

Affordability

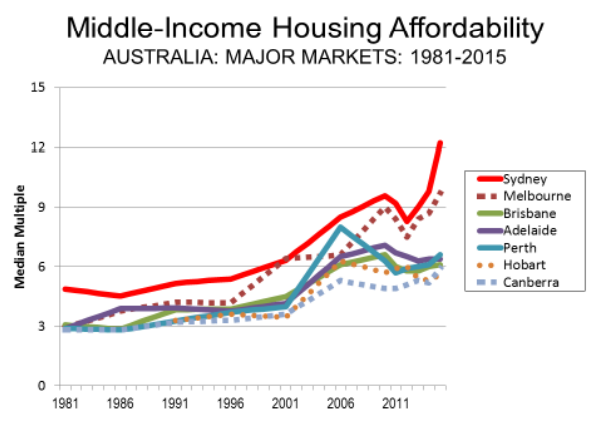

This issue has been bandied about for a long time, but the fact is that houses are more expensive now than they were in the 70’s, 80’s or 90’s.

From a ratio of 3 time’s average household income in the 80’s, we now pay 6 to 10 time’s household income for the same dwelling.

As you can see, the affordability of a house now is much worse than in any time in the past. How much more can we afford to pay?

Banks are hurting – interest rates can’t fall much further

While official interest rates can and probably will go lower, the rates that house buyers pay may not drop any further. In fact we’ve seen recently that banks are happy to raise interest rates (in October 2015, all 4 big banks raised their mortgage and investment loan rates) despite no action on official rates from the RBA.

Bank profits depend upon making a margin between what they can raise funds for (their funding costs) and what they charge mortgage holders. Bank funding costs are under pressure, as investors revise how ‘risky’ they think the banks might be (see my post HERE on Banks).

With these costs under pressure, they are not in a position to pass on further rate cuts, without eating into their profit margins.

This means mortgage interest rates are probably about as low as they will EVER get.

Wages growth

I identified earlier that one of the key drivers of house prices is income growth (there more you have, the more you can spend). As a result of the mining bust and the wholesale closure of manufacturing businesses, wages growth is the lowest in at least 15 years – barely keeping pace with inflation. If households don’t have more money, they can’t afford to pay more for houses.

Conclusion

All in all, it points to an environment that is not generally supportive of growth in house prices. We’ve been lucky to muddle through this far, but the risks are stacking up and the likelihood of a fall in property prices is increasing.

How far they fall can’t be predicted, but if our economic data continues to deteriorate, prices can go down and can stay down for a long time.

Always remember that house prices (like all growth assets) are cyclical. Nothing ever, ever, ever goes up forever.

If you want to read more on housing cycles, see my post HERE. It tells the story of the 2012 Property Investor of the Year and how they now face bankruptcy, owing more than $3 million in debt.

If you’d like to know more about how we can help you, simply contact our office to arrange a complimentary initial consultation on 07 5494 0650.