With the Federal Budget introducing potential limits on amounts accrued inside superannuation, people are starting to look for tax-effective alternatives. A long forgotten product, Insurance (or Investment) Bonds are technically a life insurance product, but they have some powerful advantages over traditional investments, especially for anyone earning more than $37,000 pa.

Advantages include:

- Unlimited contributions (no cap or tax penalties)

- Flexibility of investment options (with more being developed)

- Access to money regardless of age

- Tax at 30% during the taxed period

- Tax—free capital gains after 10 years

- Tax-free to beneficiaries upon death

- Protected from bankruptcy

- Costs on par with other options

- Income does not form part of your personal return

They are structured to work best as a long term investment with features similar to a managed fund combined with an insurance policy. Investments within the bond structure pay tax at the company tax rate (currently 30%), making this an ideal alternative for anyone on the 34.5% marginal rate or higher (ie taxable income over $37,000 pa).

Insurance Bonds also have some unique features, which add to their attractiveness for long-term investment:

Tax-free Withdrawals after 10 years:

Money can be withdrawn from the bond at any time, however if you hold the bond for at least 10 years the returns on the entire investment, including additional contributions made, will be tax free.

If you make a withdrawal within the first 10 years, the rate at which earnings in the bond are taxed will depend on when you make the withdrawal.

| Year withdrawal made | Tax treatment |

| Withdrawals within 8 years | 100% of the earnings on the bond are included in your assessable income and a 30% tax offset applies*. |

| Withdrawals in the 9th year | 2/3 of earnings on the investment are included in your assessable income and a 30% tax offset applies. |

| Withdrawals in the 10th year | 1/3 of earnings on the bond are included in your assessable income and a 30% tax offset applies. |

| Withdrawals after the 10th year | All earnings on the bond are tax free and do not need to be included in your assessable income. |

* The 30% tax offset compensates for the tax already paid on earnings by the insurance company.

125% Rule for additional investments:

Investors in investment/insurance bonds can make additional contributions each year. As long as the contribution does not exceed 125% of the previous year’s contribution, it will be considered part of the initial investment. This means each additional contribution does not need to be invested for the full 10 years to receive the full tax benefits. This allows large incremental investment, for example:

| Investment | Total Contribution | |

| Year 1 | $5,000.00 | $5,000 |

| Year 2 | $6,250.00 | $11,250.00 |

| Year 3 | $7,812.50 | $19,062.50 |

| Year 4 | $9,765.63 | $28,828.13 |

| Year 5 | $12,207.03 | $41,035.16 |

| Year 6 | $15,258.79 | $56,293.95 |

| Year 7 | $19,073.49 | $75,367.43 |

| Year 8 | $23,841.86 | $99,209.29 |

| Year 9 | $29,802.32 | $129,011.61 |

| Year 10 | $37,252.90 | $166,264.51 |

If contributions are made to the bond that exceed 125% of the previous year’s investment, the start date of the 10 year period will reset to the start of the investment year in which the excess contributions are made. You will then have to wait a further 10 years from this date to gain the full tax benefits.

If you do not make a contribution to the bond in one year, any contributions in following years will reset the 10 year rule.

Tax Advantages

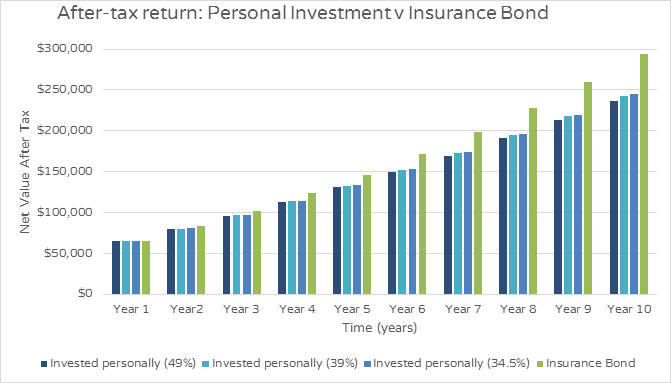

To compare the effect that tax has on investment earnings, I’ve made a quick comparison based on a common insurance bond investment:

- Starting with $50,000, an investor adds $12,000 pa in contributions

- The bond earns 7% pa (6% growth, 1% income)

The outcome (for various marginal tax rates) is shown below:

As you can see, the Insurance Bond investor is up to $52,000 better-off as a result of its flat 30% tax rate and tax-free withdrawals after 10 years. That’s a 20% improvement in return, simply by choosing the right investment structure.

Estate planning

Investment/Insurance bonds may provide estate planning opportunities for some investors. When a bond is set up, you’ll need to nominate a policy owner, a life or lives to be insured and beneficiaries. The policy owner may be the same as the life insured.

If the last insured person passes away, the beneficiary receives the proceeds from the insurance bond tax free. If there is no nominated beneficiary, the proceeds will go to the policy owner or the policy owner’s estate.

Investment bonds are especially good for estate planning as they sit outside the will and cannot be challenged.

Other Features

Insurance/Investment bonds have some other features which compare favourably to other investment options:

- Tax-free (no CGT) switching between investment options

- Some bonds offer loans against the investment (with interest rates as low as 3% pa) which allow for short-term access to funds without affecting the 10 year rule.

- Product issuers offering an increasing choice of investment options

With their tax advantages and other unique features, Insurance Bonds are definitely set for a resurgence, especially if superannuation savings are to be capped.

If you’d like to know more about how we can help you, simply contact our office to arrange a complimentary initial consultation on 07 5494 0650.