Investing Overseas – a forgotten asset class

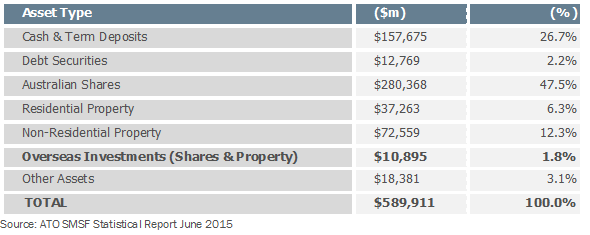

Recent figures from the ATO show that only around 2% of SMSF assets are invested overseas.

The table shows that the vast majority of SMSF assets are invested locally with a whopping 27% in cash and fixed interest. Just 1.8% is allocated to overseas investments of any type (shares and property).

This is a timely reminder to SMSF trustees to revisit their asset allocations and look beyond just cash and Australian shares.

Given current interest rates of 2%, having more than a quarter of your assets in cash is probably not a good idea. I’ll elaborate on why in a future post.

Why you should consider Investing Overseas

The figures above show that SMSF trustees have not embraced the benefits diversification.

Australian Shares

With the two key drivers of the Australian economy in decline (mining and property) we may just be starting to see the effects of a slow-down flowing through.

Going forward the performance of the local sharemarket will reflect the weakness of the economy as a whole. A weak economy would mean reductions in profits and dividends and dramatic falls in share prices.

Go to the website at www.elementalwealth.com.au and see our ‘Insights’ page for more information.

Diversification

The major tool for risk reduction is diversification. By limiting your options to only Australian based investments, your portfolio is much more leveraged to our economy. Looking overseas also gives you access to wide and varied markets and sectors, most of whom are not widely represented in Australia.

Superior Returns

As stated, overseas investment opens up a universe of investment options. This increases the chances of finding positive returns.

For a recent example, in the September quarter 2015, 24 out of the top 25 performing funds were global share and property funds. The top returning fund made 33.34% versus the Australian sharemarket which FELL more than 10% over the same period. (Source: Investsmart.com.au, Morningstar).

Currency

The Australian dollar is widely regarded as a pro-cyclical currency, meaning it tends to rise against other currencies in the good times and fall against them in the bad times. The currency is also a reflection of local economic conditions – the weaker the local economy, generally the lower the currency will fall.

These two factors give your overseas investments a natural ‘boost’ when most needed – as local conditions deteriorate, the falling currency increases the value of your international investments.

See more on how the currency affects international investments below.

How the Currency Will Affect International Investments

When you invest overseas, you are effectively buying the investments in their local currency (US dollars for US-listed stocks, Pounds for UK listed stocks etc). As the exchange rates for these currencies change, so too does the Australian dollar value of your investment.

Interest Rates Tell the Story

While there are many reasons exchange rates fluctuate, one of the key influences of a currency is the difference between local interest rates and those available overseas.

The theory postulates that if you can invest in a term deposit at a higher rate overseas than here, money will flow out of Australia (lowering our currency) into that country (raising their currency).

Interest rates are also a key tool in macro-economic management. As the economy slows, interest rate cuts can be used to stimulate growth.

A quick check on the outlook for interest rates here (falling, with another rate cut likely soon) and overseas (talks of rate rises in the US) suggests that our currency will remain under pressure. All things being equal, a falling Australian dollar will increase the value of overseas investments.

Unhedged Overseas Investments

These potential changes in exchange rate are the reason why unhedged overseas investments are my preferred option for most SMSF portfolios. These investments don’t hedge their currency exposure, which comes at an additional cost on top of the normal management fees.

While being exposed to exchange rate fluctuations is more risky, unhedged overseas investments can be used as a natural hedge against the performance of the Australian economy and the local sharemarket.

This means that if the local economy is weak, interest rates and the exchange rate will fall. This increases that value of your overseas investments, offsetting the fall in value of your local shares.

If the Australian economy performs better than expected, interest rates stay on hold or rise. While this decreases the relative value of your overseas investments, that fall should be more than made up for by the increasing value of your local shares.

Risks

While the currency fluctuations can enhance any positive returns, they can also increase negative returns, making international investments one of the most volatile. This means that the suggested investment timeframe for these funds is 7 to 10 years.

If you’d like to know more about how we can help you, simply contact our office to arrange a complimentary initial consultation on 07 5494 0650.